So you've decided to start a nonprofit organization. That's awesome! The world needs more passionate leaders putting their missions into action.

This is especially true today, as the COVID-19 pandemic, its broader economic impacts, and ongoing social justice movements have rocked communities at all levels.

Starting a nonprofit is hard but rewarding work. It takes considerable time, attention, and resources to get a new organization up and running. Before you can begin creating a fundraising plan, recruiting volunteers, and making change in the world, there are a few fundamentals you'll need to handle.

Taking the time to learn how to start a nonprofit the right way is essential for preventing unnecessary complications down the line.

Let's walk through the basic steps you'll need to follow as you start a nonprofit:

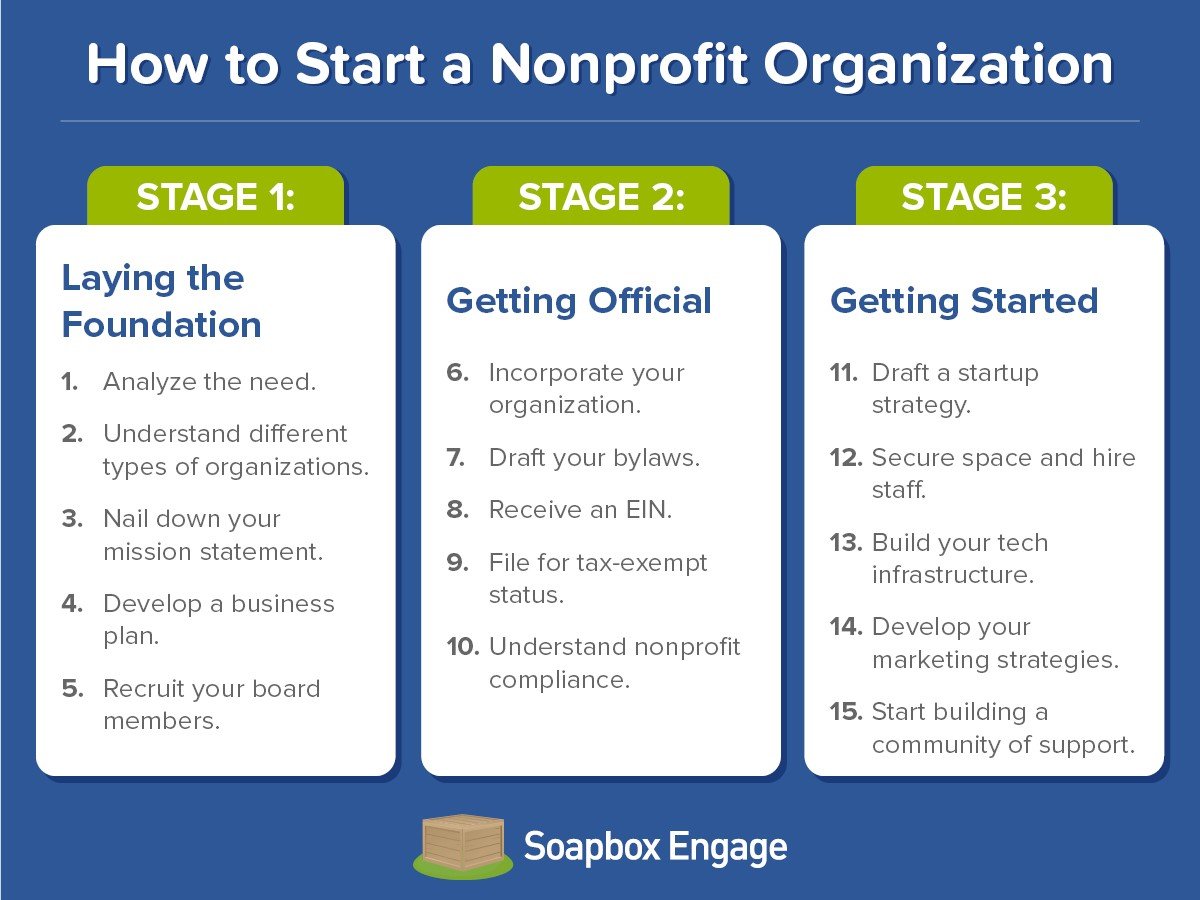

We'll break the process down into 3 core stages:

You can use this list to jump ahead to a specific stage, but we recommend following along from the top to make sure you don't miss any important points. We'll also cover frequently asked questions about starting a new nonprofit.

At Soapbox Engage, we create online fundraising and engagement tools for growing organizations. We've seen firsthand the difference that the right preparation, strategies, and resources can make for new nonprofits. All of the steps of starting a nonprofit can make or break your plans, so it definitely pays to do your research.

Ready to get started building your nonprofit and bringing your mission to life? Let's dive in.

[fundraising-newsletter-cta][/fundraising-newsletter-cta]

Starting a Nonprofit Stage 1: Laying the Foundation

Stage 1 of starting a nonprofit is all about doing your research and laying a foundation on which to build your plans. It might be tempting to skip or hurry through these steps (after all, you're in a hurry to start making change in the world), but each of these elements will have major implications for the future of your organization. This stage is the humble origin story for your nonprofit, so take your time!

Here are the core steps in Stage 1 of starting a nonprofit:

1. Analyze the need around your mission.

Before investing heavily in starting your nonprofit, determine how much need there is around your mission.

While you're certainly passionate about your cause and see the value that your nonprofit can deliver, it will ultimately be very difficult to get your organization off the ground if your community simply doesn't have a need for your services. This is less often a case of no demand or interest around your mission but rather because other nonprofits, businesses, or government agencies are already filling that need.

Conduct a needs analysis to get a better understanding of your community and its particular needs as well as how they relate to your mission or goals. Here are a few helpful resources to guide this process:

- Needs Assessment Ideas from Points of Light

- Demographic information sources compiled by GrantSpace

- Interactive demographic and economic maps from the Urban Institute

- Federal census data from Census.gov

Without a solid understanding of how exactly your nonprofit would fit into the community you wish to serve, you can unknowingly set your organization up for failure or end up harming existing nonprofits working towards the same or similar missions. Spend some time conducting research and getting to know members of your community. Involving them in the needs analysis process can be extremely helpful, and it gives you a headstart on building partnerships with local leaders and other organizations.

2. Understand the differences between various types of organizations.

For most people, 501(c)(3) nonprofit organizations are what first come to mind when they hear the general term "nonprofit". However, a much wider variety of organizations fall under the 501(c) IRS classification - 27 different types of organizations, to be exact.

The three most common types of 501(c) organizations include:

- 501(c)(3) charitable nonprofit organizations, the largest category for nonprofits that serve the public good. These organizations fall into one of two categories:

- Public charities, which are funded through donations and grants

- Private foundations, which are funded through investments and endowments

- 501(c)(4) social welfare organizations, which usually focus on much more specific needs or groups than 501(c)(3) nonprofits. Political advocacy organizations and local-level labor unions are common examples, but this category is very diverse.

- 501(c)(6) membership organizations, which typically promote the business interests of their members. Real estate boards, professional associations, and even the NFL are membership-based organizations.

Understanding the differences between common 501(c) organizations will be helpful as you begin the process of officially applying for tax-exempt status later. You likely already have an idea of which general category your own nonprofit will fall into, but do some additional research. The way that your organization is classified will directly impact your operations and funding procedures, so make sure you're heading in the right direction early in the process. Working with a legal expert now (and throughout the entire process of starting a nonprofit) is a good idea.

To learn more, check out our guide, Everything You Need to Know About 501(c) Categories Before Starting a Nonprofit, or dig into the complete index from the IRS.

3. Nail down your mission statement.

Once you understand your community, how your organization will fit in, and what type of organization it'll be, it's time for the fun part: writing a solid mission statement.

A nonprofit's mission statement expresses its core goal and purpose into a few words or a single sentence, usually around 16 words or fewer. A strong nonprofit mission statement must accomplish two main tasks:

- Telling the world why your nonprofit exists, what its goals are, and how it works to reach those goals

- Serving as a founding document or guiding light for your organization's team as you grow

Every action and decision your nonprofit makes should directly relate to your mission statement and get you closer to achieving your goals. Clearly, your mission statement is important, so take your time to get it just right. You might draft a few versions and test them out on an audience of friends (or strangers for the most objective responses) to see which resonates the most with potential supporters.

Check out these example nonprofit mission statements to see how other, well-established nonprofits crafted their own.

4. Develop a business plan.

A "business plan" might not immediately come to mind when you think about starting a nonprofit. However, it's important to remember that nonprofits need to operate strategically and efficiently just like businesses in order to achieve their goals and grow sustainably. The only difference is that your business plan won't revolve around generating profit but rather how you'll accomplish your goals.

A nonprofit business plan should seek to explain exactly how you'll achieve your mission in as specific detail as possible. What does success look like for your nonprofit? What specific initiatives, partnerships, or programs will get you there?

This is your nonprofit's roadmap, so it's important to give it plenty of thought early in the process. Nonprofit business plans should cover several fundamental points, so try to get yours as comprehensive as possible. Of course, you can continue developing your business plan over time, but the earlier, the better. You might want to tackle this step simultaneously with the next step, recruiting board members.

Additionally, make sure that you fully understand how nonprofits generate and use revenue. Remember these essentials:

- Nonprofit revenue tends to come from two main sources: individual donations and grants from government agencies or foundations.

- Nonprofits also must adhere to a fund accounting system that classifies revenue as either restricted or unrestricted.

- In order to keep your tax-exempt status, nearly all of your revenue must go back into furthering your mission and supporting your operations. There are a few earned income opportunities that nonprofits can use to generate "profit," but at this early stage, you should be fully focused on fundraising and pursuing your mission. If too much of your revenue goes towards work not directly related to your mission, you can lose your 501(c)(3) status.

- Nonprofit directors can receive a salary, but board members and other partners cannot be compensated for their volunteered time.

Make sure your nonprofit's big-picture business plan takes all of these revenue essentials into account. You definitely don't want to build a strategy around a tactic that will ultimately risk your status as a nonprofit.

5. Recruit your nonprofit's board members.

Your board of directors is your nonprofit's governing body. These key volunteers will be the decision-makers for your nonprofit now and in the future.

There are a number of characteristics to look for in a nonprofit board member, like:

- A shared passion for your mission and community

- The free time to devote to supporting your nonprofit and attending meetings

- The ability to carry out a variety of roles as needed

- Ideally, expertise in elements of your operations that you're unfamiliar with, like legal and financial oversight

The positions and people serving on your board will certainly change as your organization grows over time. For your first board members, you'll likely look to friends who match the description above and local figures or businesspeople with a shared interest and stakes in your mission. You'll need a finalized board of directors when filing your 501(c)(3) application, and your board members will also be invaluable partners for working out your nonprofit's early strategies, so don't put off this step. Check out these resources for more support with forming your first board:

- Nonprofit Governance: Best Practices and Mistakes to Avoid

- The Most Common Nonprofit Governance Models

- Four Steps to Assemble a Board of Directors

The IRS recommends that you recruit at least three board members, although specific minimum requirements may vary by state. Do some research or contact your state's nonprofit association for more information.

[fundraising-newsletter-cta][/fundraising-newsletter-cta]

Starting a Nonprofit Stage 2: Getting Official

In the second stage of starting a nonprofit, it's time for the paperwork. Although these steps aren't quite as fun as drafting your mission statement or developing your first programs, they're crucial for getting your nonprofit up and running. Follow these steps in the order they're presented here, as you'll need proof of each to complete your 501(c) application for tax-exempt status.

Here are the core steps of Stage 2 of starting a nonprofit:

6. Legally incorporate your organization.

Legally incorporating your new organization is what officially creates it as an actual legal entity. This step doesn't take very long, but it's essential. At a minimum, you'll need the following information to include in your articles of incorporation:

- Your organization's name

- Your mission or a brief explanation of your purpose

- A registered agent, either a board member or a hired specialist, and an address to receive and handle official documents

- The specific type of nonprofit entity and 501(c) tax exemption that you'll apply for later

- The names of your initial board members

- An incorporator to sign and submit the documents, either yourself or an attorney

Like for new businesses, articles of incorporation for nonprofits are typically filed with your state's Secretary of State. Explore your state government's website for specific guidelines, requirements, and templates. State fees for filing for incorporation often range between $50 to $400, so check in advance.

For a full breakdown and a basic template, check out this guide to nonprofit articles of incorporation from the experts at Harbor Compliance.

7. Draft your nonprofit's bylaws.

Your nonprofit's bylaws are the rules that you establish for how your organization will run. Work with your board members and an attorney or your legal counsel to draft up a comprehensive set of governance guidelines - bonus points if one of your board members is an attorney with expertise in this area! Your bylaws will need to comply with relevant state and IRS requirements, so you definitely don't want to rush through this step.

A nonprofit's bylaws must cover a few essentials, including:

- The size of the board of directors and how it will function, including how members are elected and vote on decisions

- Roles and duties of the nonprofit's directors and other officers

- Meeting procedures and rules for appointing or electing officers

- Policies covering conflicts of interest and how they'll be handled

- How assets like grant funding will be distributed if not restricted

All other essential details also need to be included, so doing your research and working with a legal expert is a smart move. You'll have to include your bylaws in your 501(c)(3) application, so any mistakes can delay a process that is already quite lengthy.

In addition, your nonprofit's bylaws aren't required to be made public, but it's often a good idea to make them freely accessible. This will boost your transparency and encourage board members to stay familiar with them. You can update and amend your bylaws over time, but remember that you'll need to report any changes to the IRS in your annual reports and Form 990s.

For more information, check out this compilation of nonprofit bylaw resources.

8. Receive an EIN for your organization.

An EIN, or Employer Identification Number, is essential for completing the process of making your nonprofit a legal entity. Your EIN is what identifies your organization to the IRS, and you need one regardless of the exact type of organization you're starting or the 501(c) classification you're filing for.

This step is fairly fast and easy, but remember that your EIN is not your tax-exempt number, which is assigned by agencies at the state level.

Follow instructions from the IRS to apply for your nonprofit's EIN.

9. File for tax-exempt status.

Here comes the big step you've been waiting for: filing for tax-exempt status with the IRS.

The process is similar for most types of exempt organizations, so we'll specifically walk through how to file and start a 501(c)(3) nonprofit organization. Let's recap the essentials you've already completed as well as the next steps in the process:

I. File articles of incorporation with your state government.

II. Apply for and receive an EIN from the IRS.

You must have already incorporated your organization prior to applying for an EIN.

III. Complete and submit the IRS Form 1023.

This is the main document of the process for starting a 501(c)(3) nonprofit. You'll need to include a few essentials when you submit your application:

- The completed 1023 form

- The signature from an authorized individual, like your incorporator or legal counsel

- Your organization's EIN and a copy of your articles of incorporation (also called your charter)

- A copy of your complete bylaws

- A statement of receipts and expenses generated thus far

- Detailed explanations of your initial proposed activities and programming

Completing the Form 1023 and compiling all of the necessary documentation can be an overwhelming process for newcomers, so, again, it's a good idea to work with an attorney or legal professional if possible.

Once you've incorporated your organization and received an EIN, there is a deadline of 27 months to file for tax exemption. This deadline is only for your completing and submitting the application, not receiving 501(c)(3) status. Once you apply, it can take a year or more for the IRS to complete the review process and finalize your tax-exempt status.

If you're starting a nonprofit that isn't a 501(c)(3), like a social welfare organization or membership organization, the exact process and forms you'll follow will differ at this stage. Research IRS guidelines and work with an attorney to determine your exact course of action.

IV. Check for any state 501(c)(3) requirements.

Depending on where you're starting a 501(c)(3) nonprofit, you may be required to take additional steps to ensure that your organization is fully recognized as tax-exempt and can legally solicit donations. Understanding your federal and state compliance needs will be an ongoing responsibility for the entire life of your organization, so go ahead and get started with any necessary state filings while you're already in full paperwork mode.

V. Get started running your nonprofit.

You don't have to wait until the IRS fully approves your 501(c)(3) application to begin operating your nonprofit. The IRS has specific policies in place for organizations with pending applications. Just recognize that any donations received during this period will not be tax-deductible by donors if your application is ultimately rejected.

The most important tip we can share for officially starting a 501(c)(3) is to be patient! It's a lengthy and complex process, so don't get frustrated or bogged down.

Every nonprofit, from the smallest local organizations to the largest national charities, have gone through the same essential steps. If it's an option for your organization, working with an attorney will be extremely helpful.

10. Understand your ongoing federal and state compliance requirements.

As mentioned in the previous step, federal and state nonprofit compliance will be ongoing concerns for your organization for as long as it operates, so get started researching your requirements now.

The world of nonprofit compliance may be a little dry for newcomers, but it's expansive and extremely important for you to understand. Noncompliance can result in your organization losing its tax-exempt status and credibility. We recommend working with professionals and doing more research to fully understand your exact compliance needs, but here are a few of the biggest nonprofit compliance requirements to keep in mind:

- Your organization must be fully registered as a tax-exempt fundraising organization in your state in order to solicit donations. If you want to legally fundraise in other states, you'll most likely need to register there, as well.

- You'll need to file an annual Form 990 with the IRS. This document summarizes your financial activities, governing processes, and staff and board changes. It helps the IRS determine whether or not the majority of your revenue is being re-invested in your community and programming. If you don't file this form for three consecutive years, your tax-exempt status will be revoked. Working with professional-grade fundraising software will make it much easier to accurately track and report your finances (more on software below).

- Understand your organization's ADA compliance requirements. Many nonprofit organizations are subject to the Americans with Disabilities Act, specifically any organization with 15 or more employees or any organization classified as a "public accommodation." If applicable, ADA compliance will apply to your nonprofit's physical premises and (increasingly common) your website.

As your organization grows, you'll also need to comply with any and all responsibilities as an employer. Nonprofit HR often tends to get neglected in the early days of an organization, but it's worth familiarizing yourself with the essentials if you'll be hiring any employees in the short- or long-terms.

Clearly, compliance is a complex area, but it's so important that your organization gets it right. Your best bets will always be to stick with federal and IRS guidance, state-specific guidance, and help from an attorney or compliance expert familiar with the nonprofit sector.

[fundraising-newsletter-cta][/fundraising-newsletter-cta]

Starting a Nonprofit Stage 3: Getting Started

Congratulations on building a solid foundation for your new nonprofit organization and getting its official paperwork in order! Now it's time to get started running your organization and begin pursuing your mission. These final steps in the process will help you build smarter funding, technology, and marketing strategies into your organization from the start.

Here are the core steps in Stage 3 of starting a nonprofit:

11. Draft a nonprofit startup strategy.

Most brand new nonprofit organizations have one thing in common: they're extremely short on resources. Getting up and running as a nonprofit takes a long time and can get expensive. In the earliest days of your organization, it's a good idea to have a plan in place for securing startup funding.

Nonprofits of all sizes rely heavily on grants throughout their entire life cycles, but outside grant funding is especially important when you're just starting out. These are some of the most common sources for nonprofit grant funding:

- Grant-giving private foundations of all sizes

- Federal endowments and grant programs, like the National Science Foundation or National Endowment for the Arts

- State and municipal grant programs designed to support charitable work at the local level

- Corporate giving programs, including matching gift and volunteer grant programs

To explore federally-funded grants, check out grants.gov. For state, local, and private grants, we recommend this collection of startup resources from GrantSpace broken down by region and state. Your state association of nonprofits can be a helpful resource, as well.

If you're new to grants, explore our guide to identifying the right grant opportunities for your nonprofit. It provides an overview of nonprofit grants, more sources to explore, and ways to prepare for the grant writing process.

Grant writing is its own major undertaking, so it pays to do your research before diving right into applying for a grant. This is why getting started early and having a clear idea of the first initiatives, campaigns, and programs you want to offer will be helpful. If you're not in a major rush to come up with programming ideas, it's easier to find the grant opportunities that are a better natural fit (and that you're therefore more likely to win!) than blindly trying to adapt your plans to the first startup grant opportunity you find.

The main takeaway is to put some thought into what exactly your first steps as a nonprofit will be in terms of startup funding. Getting any organization off the ground is a challenge, but having even the beginnings of a strategy will give you a major leg up.

12. Secure space and hire staff if needed.

This step will vary greatly depending on the specifics of your new organization. If you're a very small operation, consisting of just yourself and board members working out of your garage, a physical office and hired staff likely won't be on your radar for some time. For organizations starting out with more resources at their disposal, an office and a staff member or two to support your work might be more feasible. During the ongoing COVID-19 pandemic, leased physical spaces might not be the right move for any new organization just yet!

New organizations that provide tangible or physical services to the public likely require space, staff, and resources to start up their operations. In these cases, grants, partnerships, and loans will likely be essential.

Although some overhead expenses are unavoidable and necessary for nonprofit organizations, it will probably be best to avoid generating too many overhead costs in the first several years of your nonprofit's existence.

Of course, this will vary from nonprofit to nonprofit. A small nonprofit advocacy group can more easily pursue its mission without a physical space (or even completely virtually) than an animal shelter. The goal is to prioritize your mission while still being careful. Once you have a solid network of partners, an established donor base in your community, and a track record of successful projects or campaigns, committing to larger overhead costs like leases and larger teams of paid staff will be less risky.

13. Build your tech infrastructure.

A solid first toolkit of fundraising technology will put your new nonprofit in a great position to immediately begin making the most of the opportunities you find.

Explore the "Building your nonprofit fundraising toolkit" section of our nonprofit fundraising guide for a complete rundown of the different types of software that growing nonprofits typically need. Online or virtual fundraising is more important than ever (especially due to the COVID-19 pandemic), so you'll need to invest in technology to one degree or another.

There are a ton of nonprofit software solutions on the market, probably much more than you might initially think. Like any other type of software designed to help an organization get a job done, nonprofit technology spans the full range from extremely expensive, highly functional tools all the way to free but extremely limited platforms. Remember, even as a brand new nonprofit, you don't have to sacrifice quality for cost.

It's easier than ever to get set up with professional-grade tools that actually suit your needs and budget as a small nonprofit. Our own suite of Soapbox Engage fundraising and engagement apps are a great example. With a fully-functional, modular, and affordable toolkit, your organization can start building out your tech infrastructure and online fundraising presence in no time. Check out these additional resources on nonprofit technology to get started:

- Best Nonprofit Fundraising Software: Our Top Picks

- Donate Buttons: Overview and Best Practices for Nonprofits

- Accept Donations Online: Effective Tools for Nonprofits

For extra support through the process of building your tech toolkit (or just learning the lay of the land), working with a nonprofit technology consultant can be a smart move if you have the resources to do so. Alternately, asking peer organizations in your area for their recommendations and insights is always an easy first step.

Our main tip: Avoid committing to a wide range of disconnected tools that don't work well together. Look for software that can more easily integrate with one another. This makes it much easier for your toolkit to grow along with your organization rather than need constant (expensive) upgrades over time.

14. Develop your first marketing strategies.

Once you've created ways for your supporters to actually make online donations to your nonprofit, it's time to start promoting your work! Develop a fundraising and marketing campaign to start getting the word out about your new organization. We recommend these starter strategies:

- Make sure your website is top-notch. There's no excuse for a poorly-designed or clunky website these days. Without a great website that tells the story of your organization, explains your mission, and makes it easy for supporters to donate, you could have a hard time attracting much attention for your nonprofit.

- Rely on social media. For very small nonprofits, your first circle of supporters will likely be made up of mainly (if not all) people who you and your board members personally know. Social media will be a powerful tool for getting your nonprofit's name out there. Ask your friends and family to share your organization's posts and donation appeals. Peer-to-peer fundraising is the standard term used by nonprofits to describe this style of social media fundraising. Just make sure you've got an easy-to-use donation page with peer-to-peer fundraising features built-in!

- Understand your target audience. Take some time to think about who your target donor is. What draws them to your mission? What do they care about? How old are they? Understanding your audience is essential for making your outreach as effective as possible. Target them with messages and campaigns that speak to their interests for the best results. As your nonprofit grows, more advanced donor segmentation strategies will help you maximize the impact of your strategies in a similar way.

- Take a multichannel approach. Although it might sound overwhelming, a multichannel marketing campaign is fairly easy to plan. Use each of your marketing outlets (email, social media, print ads, your website, etc.) to generate and send more traffic to one another. For instance, in your social media posts, send readers to a blog post on your website. On that blog post, you might direct readers to join your email list or make a donation. The main idea is to keep readers as engaged as possible with your marketing materials in order to increase the chances they'll make a donation. Explore this guide to nonprofit digital strategy for more information.

Marketing and promoting your nonprofit will be an ongoing task for the length of your nonprofit's operations. Get started learning the basics early! Marketing might seem like a complex task to tackle all at once, but it's fairly easy and perfectly fine to take your time mastering one strategy at a time.

As a foundation to build your strategies on, we definitely recommend investing in a way to track supporter and donor data via a database or constituent relationship management (CRM) software. This will make generating and automating your communications a breeze as you grow.

15. Start building a community of support.

So you've officially started your nonprofit organization, gone through the entire process to get official tax-exempt status, and started reaching out to potential donors. Take a moment to congratulate yourself!

However, like fundraising and marketing, there are a number of important tasks that you'll need to tackle for the entire life of your organization. Getting started with them as early as possible gives you more experience and pays off over the long-run. Specifically, you need to start building a community of support while your nonprofit gets off the ground.

Nonprofits need more than just donors to thrive. You need a network of partners in your community who can provide you with essential connections, increased visibility, resources, advice, and more. Think of potential partners like these:

- Your state's association of nonprofits

- Other nonprofit organizations of all types in your area

- Local business owners and community leaders

- Potential major donors in your area known for their philanthropic efforts

Building a solid network of donors, peer organizations, businesses, and more who support your mission and see the value of your work will be invaluable as your nonprofit grows. Check out this comprehensive roundup of resources by state to learn more about the nonprofit landscape in your area.

Read our longer guide, The 7 Rules of Effective Networking for Nonprofit Fundraisers, for a complete breakdown of best practices to follow.

[fundraising-newsletter-cta][/fundraising-newsletter-cta]

Starting a Nonprofit FAQ

How long does it take to start a nonprofit organization?

The entire process of starting a nonprofit, including laying out your mission and strategy, filing for tax-exempt status, recruiting board members, and more, can easily take two years or more. Then, depending on your exact mission and goals, it could take another year or more to begin launching on-the-ground programming. Starting a nonprofit definitely takes patience and dedication, but finally being able to pursue your mission with concrete action makes all the hard work worth it.

How much does it cost to start a nonprofit organization?

The total costs of starting a nonprofit will vary greatly from one case to the next. However, it's not free. As with any kind of startup organization, it takes money to get a nonprofit off the ground. Fees for incorporating your nonprofit, submitting your application for 501(c)(3) status, and any help from legal professionals are common startup costs for most nonprofit organizations. Software and web design are standard startup fees to be expected by any organization today. If your nonprofit immediately needs office space and paid staff, those are additional overhead expenses to keep in mind. Startup grants, loans, and (often) the savings of their founders help to sustain new nonprofit organizations over their first several years of existence.

Are there different types of nonprofit organizations?

Yes, a very wide variety of organizations fall under the broader 501(c) IRS classifications. 501(C)(3) nonprofits are the most common. We cover the different types of nonprofit organizations that you might start in Stage 1 of this guide.

Can you make money as a nonprofit organization?

Yes, but not in the same sense that a business generates "profit." Nonprofit organizations pay salaries to their directors and other staff members (not volunteer or board members). However, the vast majority of revenue that a nonprofit generates through fundraising and offering services must be reinvested into pursuing its mission and the social good of its community. Paying your overhead expenses like office rent and staff salaries are considered necessary parts of pursuing your mission. Nonprofits report their fiscal activities to the IRS by filing a Form 990 annually. If the IRS sees that a nonprofit spends more on enriching itself and its partners, it will lose its tax-exempt status (and credibility with donors).

Wrapping Up

Starting a nonprofit is clearly hard work! From building a foundation for your strategy and detailing your mission to getting official with the IRS and setting up your first toolkit of fundraising software, there's a lot to handle.

Remember, be patient. Nonprofits very rarely get up and running at full speed in less than a few years. You're doing good work for your community and the world, so it's okay if you don't immediately make the kind of major impact you're envisioning right now. It takes a while to build up a nonprofit's steam, but once you're at full speed, you'll be unstoppable.

For more insights on nonprofit operations and online fundraising, sign up for our blog updates. We send out quick notifications and roundups on the latest fundraising trends, and we think they'll be helpful as your own organization gets started raising support for its mission.

And to continue your research, check out a few additional resources:

- Nonprofit Fundraising: Complete Guide for 2020 + Checklist. New to fundraising as a nonprofit? We've got you covered with this crash course.

- Virtual Fundraising Ideas During COVID-19. The COVID-19 pandemic has shaken up the world of fundraising. Virtual engagement is the new norm. Learn more with these top ideas.

- Free Fundraising Software: 15+ Tools for Growing Nonprofits. Check out these free software providers to help new organizations get up and running fast.

[fundraising-newsletter-cta][/fundraising-newsletter-cta]